2016 semiconductor capex highest in 5 years

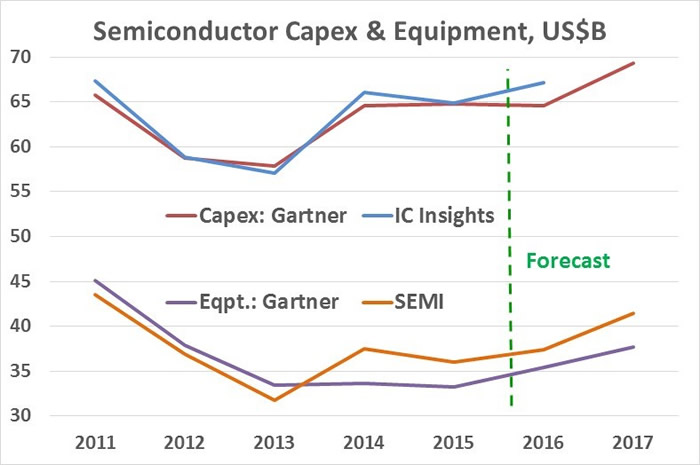

Global semiconductor capital expenditures (capex) are expected to return to the level of 2011 either this year or next. 2011 was the record year for capex as the industry returned to growth following the 2009-2010 recession. IC Insights’ August 2016 forecast called for 3.5% growth in capital spending to reach $67.1bn, the highest level since $67.4bn in 2011. Gartner’s October 2016 projection was a slight 0.3% downturn in 2016 followed by 7.4% growth in 2017 to reach $69.3bn, surpassing $65.8bn in 2011.

Semiconductor manufacturing equipment accounts for about half of semiconductor capital spending. In August 2016, SEMI called for 4.1% growth in equipment in 2016, accelerating to 10.6% in 2017. Gartner’s October forecast has fab equipment growing in the 6% to 7% range in both 2016 and 2017. Neither SEMI nor Gartner has 2017 equipment returning to the 2011 levels of $44bn to $45bn.

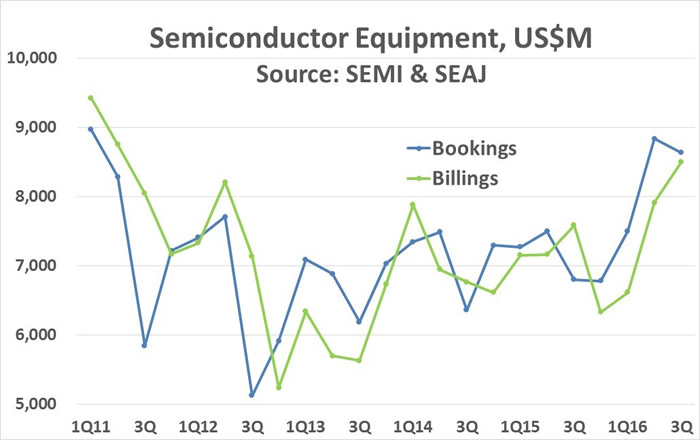

Solid growth in semiconductor fab equipment in 2016 is supported by data from SEMI and the Semiconductor Equipment Association of Japan (SEAJ). Combined SEMI and SEAJ data shows 3rd quarter 2016 semiconductor manufacturing equipment billings were $8.5bn, up 7% from the prior quarter and up 12% from a year ago. Bookings were $8.6bn up 27% from a year ago but down 2% from the prior quarter. The resulting book-to-bill ratio was 1.02. We at Semiconductor Intelligence are projecting full year 2016 equipment billings will be up 12% from 2015. The slowing in bookings could be indicating billings are close to a peak. However even if billings remain at the 3rd quarter 2016 level through the end of 2017, 2017 growth would be around 8%.

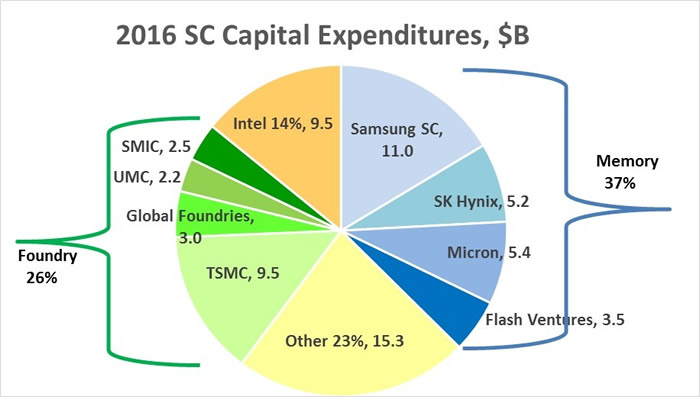

Which companies are driving semiconductor capital spending? For several years, capex has been dominated by microprocessor giant Intel, the largest memory company Samsung, and the major wafer foundry TSMC. These three companies have accounted for 44% to 56% of total capex for each of the last five years. The table below shows the largest companies in capital spending based on 2016 projections. Most of the 2016 numbers are based on company guidance. IC Insights estimates were used for Samsung, GlobalFoundries and total capex.

Samsung should have the largest capex in 2016 at $11.0bn, according to IC Insights. Samsung has had the largest capex for several years. Intel and TSMC are each projecting 2016 capex of about $9.5bn. The four largest memory companies account for 37% of capex. Besides Samsung, Micron Technology capex is $5.4bn (based on fiscal 2016 ended September 1) and SK Hynix projects $5.2m. Micron should pass SK Hynix to become the second largest memory company in capex for the first time. Flash Ventures, a joint venture flash memory company between Toshiba and SanDisk (now part of Western Digital) should spend $3.5bn.

The four largest foundry companies total 26% of projected 2016 capex. After TSMC, the next largest companies are GlobalFoundries at $3.0bn, SMIC at $2.5bn and UMC at $2.2bn in capex. GlobalFoundries has lowered capex each of the last two years after peaking at $5.0bn in 2014. China-based SMIC has been aggressively increasing capex averaging 50% annual growth over the last four years to hit $2.5bn in 2016.

Other companies make up 23% of projected 2016 capex. This category includes major semiconductor companies such as Infineon Technologies, NXP Semiconductor (now including Freescale), Renesas Electronics, STMicroelectronics and Texas Instruments. As new wafer fabs have become more expensive (now costing several billion dollars) these companies are depending less on internal fabs and increasingly turning to foundries. Intel is an exception since it has a large economy of scale and sees its process technology as a competitive advantage. The memory companies also have economies of scale. In addition, the memory market is highly commoditized and price sensitive, making it difficult for a company to compete without its own wafer fabs.

The “other” category has been declining as a percentage of total semiconductor capex, from 39% in 2010 to 23% in 2016. The category will continue to decline in the future as capex is increasingly dominated by memory companies, foundry companies and Intel.

Comments are closed, but trackbacks and pingbacks are open.