21% Surge in IC Unit Shipments Forecast This Year

This week, IC Insights will release its Mid-Year Update to The McClean Report 2021 that includes its most current forecast for the global IC market from 2021 through 2025. After a six percent drop in IC unit shipments in 2019, and an eight percent increase in 2020, IC Insights forecasts a huge 21% jump in IC unit shipments this year.

Unit shipments in 2021 are forecast to reach 391.2 billion, more than 11x the 34.1 billion units shipped over 30 years ago in 1990. The 2020-2025 IC unit volume CAGR is forecast to be 11%, five points more than the unit CAGR from 2015-2020.

When ignoring the five-year CAGR time periods with abnormally high or low endpoints, IC Insights believes that the long-term outlook for IC unit shipments is for a CAGR of seven to eight percent, just below its 30-year rate of nine percent.

Illustrating how rare a drop in IC units shipments is, 2019 was only the fifth time in the history of the IC industry that IC unit volumes declined (the previous four years were 1985, 2001, 2009, and 2012) and there have never been two consecutive years of declining IC unit shipments.

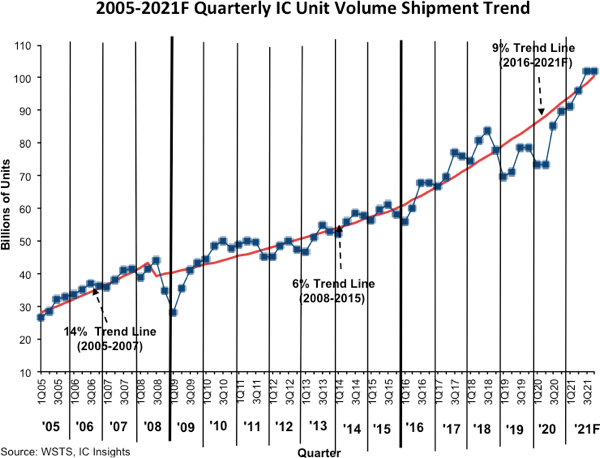

Figure 1 shows the quarterly IC unit volume shipments as compared to the trend line from 2005 through a forecast for 2021. In 2008, underlying demand for ICs plummeted as the global economic recession hit with full force in the second half of the year.

The CAGR trend line for IC unit volume from mid-2008 through 2015 was reduced to six percent from the historical CAGR of nine percent. One of the primary reasons for this was that worldwide GDP increased at an average of only 2.1% over this eight-year period.

Moreover, even with a six percent decline in IC unit shipments in 2019, the expected 2016-2021 quarterly IC unit volume shipment trend line is forecast to increase three percentage points to 9%, spurred by the expected huge 21% jump in IC unit shipments in 2021.