IC Insights will release its August Update to the 2020 McClean Report later this month. This Update includes a discussion of the IC foundry market trends and a look at the top-25 1H20 semiconductor suppliers. The top-10 1H20 semiconductor suppliers are covered in this research bulletin.

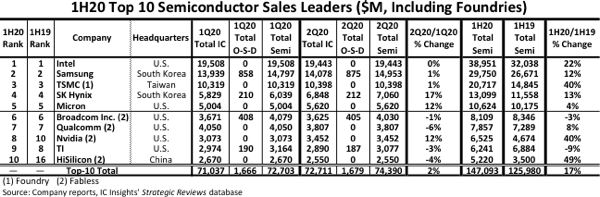

The top-10 worldwide semiconductor (IC and O-S-D—optoelectronic, sensor, and discrete) sales ranking for 1H20 is shown in Figure 1. It includes six suppliers headquartered in the U.S., two in South Korea, and one each in Taiwan and China. The ranking includes four fabless companies (Broadcom, Qualcomm, Nvidia, and HiSilicon) and one pure-play foundry (TSMC).

In total, the top-10 semiconductor companies’ sales surged by 17% in 1H20 compared to 1H19, more than 3x the total worldwide semiconductor industry increase of five percent. All of the top-10 companies had sales of at least $5.0 billion in 1H20, two companies more than in 1H19. As shown, it took $5.2 billion in first half sales to make it into the 1H20 top-10 semiconductor supplier list.

HiSilicon was the one new entrant into the top-10 ranking in 1H20, replacing Infineon. HiSilicon is the semiconductor design division of China-based telecommunications giant Huawei. Over 90% of HiSilicon’s ‘sales’ go to its parent company and are essentially internal transfers. As shown, HiSilicon’s year-over-year sales surged 49% in 1H20 and the company jumped up six spots in the ranking to 10th place, making it the first China-based semiconductor supplier to be ranked in the worldwide top-10 listing.

However, HiSilicon’s time in the top-10 ranking may be short lived. After the second round of U.S. sanctions, which prohibited semiconductor suppliers from using US-made equipment to produce devices for Huawei/HiSilicon, the company’s chip manufacturers (e.g., TSMC) only accepted orders until May 15th and production is due to end on September 15th, according to Richard Yu, president of Huawei’s consumer unit. He added that this year may be the last generation of Huawei’s high-end Kirin chips, the application processors used in Huawei’s advance smartphones, and that Huawei’s smartphone production has ‘no chips and no supply’.

The top-10 ranking includes one pure-play foundry, TSMC, which registered a strong 40% 1H20/1H19 jump in revenue. Much of this increase was due to a surge in sales of 7nm application processors to Apple and HiSilicon for their respective smartphones. If TSMC was excluded, Infineon would move into 10th place in the ranking.

IC Insights includes foundries in the top-10 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a marketshare ranking, and realizes that in some cases the semiconductor sales are double counted. With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant ‘holes’ in the list of top semiconductor suppliers.

As shown in the listing, the foundries and fabless companies are identified. In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

Overall, the top-10 list shown in Figure 1 is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies, or foundries.

Many of the top-25 semiconductor companies’ have provided their sales guidance for 3Q20, which will be presented and discussed in the August Update. Overall, the top-25 3Q20 semiconductor revenue expectations vary widely by company, as would be expected during the height of the current pandemic, and currently span a range of 40 percentage points (-8% for Intel and +32% for AMD).