Mainland China in 2018 surpassed the United States to become the world’s largest sub-regional market for programmable logic controllers (PLCs), with estimated revenue of $1.7 billion in 2018, according to the latest PLCs Report from IHS Markit | Technology, now a part of Informa Tech.

By Rita Liu, senior analyst, IHS Markit

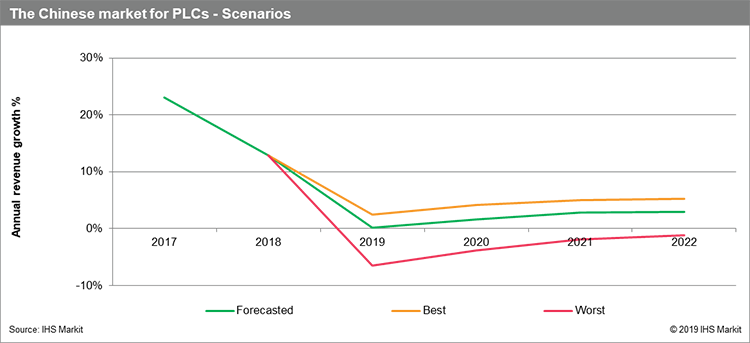

After a spike in PLC demand in 2017, the dynamics of downstream industries that purchase PLCs changed dramatically, taking a turn for the worse. As a result, IHS Markit | Technology forecasts the growth rate of the PLC market will reach a low point in 2019.

Highlights

- Both sales and production of global carmakers have continued to slump by a major margin on a quarter-by-quarter basis. This has placed great pressure on the manufacturing market, due to the auto business’s broad influence on related upstream and downstream industries.

- After reaching a peak in 2017, highly cyclical industry sectors like the semiconductors, electronics and the electronics assembly businesses have gone into the trough of the industry cycle in 2019.

- China’s robotics industry sector witnessed its first contraction of both sales and production starting in October 2018, after almost 20 years of rapid growth of more than 20 percent annually. This reflects the weak performance of the key downstream industries for robotics, like automotive, food beverage and tobacco; and electronics and electronics assembly. The robotics market may provide a good opportunity for robotics vendors to further improve efficiency, enhance the level of collaboration with humans, and learn how to leverage transformative technologies like artificial intelligence and machine vision.

- The machine-tool industry, as the basis of manufacturing, is feeling the impact of weak demand from the downstream industry sectors mentioned above. The Chinese machine-tool industry may undergo a reshuffling in 2019, with some local machine tool vendors struggle with losses.

Apart from inherent attributes of the downstream industry markets, political and economic factors also are casting a shadow on the industrial automation market. The U.S.-China conflict significantly reduced investor confidence and expectations for the Chinese market. Meanwhile, manufacturers have floated the possibility of shifting operations from China to other subregions, like India, Thailand, Vietnam, Indonesia and Mexico.

On the other hand, the increasing awareness of the energy crisis will prompt more investment by the oil and gas industry. The related discrete and process industry sectors will benefit from these energy investments during the next five years.

Other industry sectors, like materials handling, construction machinery, electric vehicles and renewable energy, will drive China’s industrial automation market to some degree during the next five years. Some initiatives, like the infrastructure investment plans launched in late 2018 and China’s ‘One Belt and One Road’ program, also will help propel market growth.

Based on the current complex and variable political and economic situation, IHS Markit | Technology has developed best- and worst-case growth scenarios for the Chinese PLC market from 2019 through 2022, as shown below.