Chips and Science Act of 2022 – What Could Go Wrong?

Its full name is Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022. The CHIPS Act, as it is more commonly known, was signed into law on August 9, 2022. The Act provides for $280 billion in spending over the next ten years, with $200 billion targeting scientific R&D and commercialization, $52.7 billion for semiconductor manufacturing, R&D, and workforce development, $24 billion worth of tax credits for chip production and $3 billion for programs aimed at leading-edge technology and wireless supply chains.

The legislation has several goals, including:

- Boost U.S. competitiveness, innovation, and national security

- Increase investments in domestic semiconductor manufacturing

- Jumpstart R&D and commercialization of leading-edge technologies, specifically quantum computing, A.I., clean energy, and nanotechnology

- Promotes innovation in wireless supply chains that use open and interoperable radio access networks

- Create regional high-tech hubs

- Create a larger, more inclusive STEM workforce

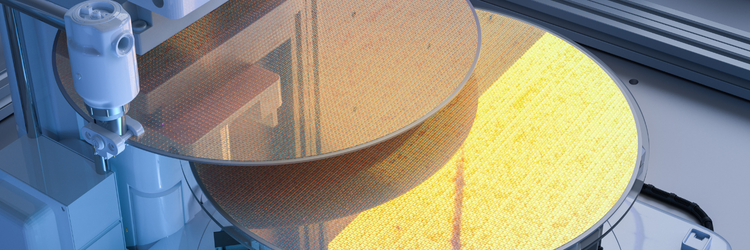

Today, the U.S. produces 10-12% of all computer chips (and none of the most advanced chips). As late as the 1990s, that number was at 37%. East Asia accounts for 75% of worldwide production. McKinsey research estimates that semiconductors will be a $1 trillion industry by the decade’s end. Taiwan, South Korea, Japan, and China heavily subsidize semiconductor manufacturing and R&D, resulting in the U.S. being unable to compete.

The pandemic would have done enough damage to the semiconductor industry; however, higher transportation costs and potential dangers in U.S. dependency on China are leading the charge to reshore chip manufacturing.

Early results

To date, several companies have tapped into the funds, including:

- Intel committed $20 billion to manufacturing facilities in Ohio, and the company claims the CHIPS Act may increase their investment to $100 billion

- Micron announced a $40 billion investment in memory chip manufacturing that it says will create up to 40,000 new jobs in construction and manufacturing

- A partnership between Qualcomm and GlobalFoundries includes $4.2 billion to manufacture chips in an expansion of GlobalFoundries’ New York facility

- Samsung announced its intent to build plants in Texas, projected to cost approximately $200 billion

The Act, however, is far from a blank check. Recipients must demonstrate significant worker and community investments and opportunities for small businesses and disadvantaged communities. Companies cannot use the funds to build certain facilities in China and other countries of concern. Recipients cannot use the taxpayer funds for stock buybacks and shareholder dividends. And conditions also include things like offering well-paying, union construction jobs and requiring Davis-Bacon prevailing wage rates for facilities built.

What could go wrong?

Indeed, the bill’s passing is already showing early results, with commitments from companies to construct or expand U.S. chip fabrication plants. Without the stimulus, these investments may not have happened, or the funds would go for construction outside of the country. There are, however, still more than a handful of challenges that the CHIPS Act won’t fix. These include (but are not limited to):

- While bolstering STEM education is a great thing, it will take a long time before it churns out the workforce to match the needs of the semiconductor industry in the U.S.

- Along the same lines, while some facilities are already breaking ground, at best, it will be two more years before their coming online could make any difference to the industry.

- There are also significant threats to the economy. The pending recession will not be kind to the demand side for semiconductors—and again, it’s difficult to project the impact on consumer electronics, automotive, and many other industry segments. As there is the potential for a glut of capacity, we are unsure what the impact will be on those involved in costly construction.

- We live in dangerous times—the threat from China is not only the race to capitalize on new technologies before we do. A Taiwan-China conflict can send the already fragile supply chain into a proverbial tailspin.

- TSMC’s Arizona plant, once producing, will provide approximately 1% of its global capacity. S. companies such as Apple, Amazon, and Google rely on TSMC for about 90% of their chip production. The company will likely send the chips made in Arizona to Asia for testing and packaging and then to China for assembly into smartphones and computers.

- The CHIPS Act is a one-time bolstering of the industry. Asia, in comparison, subsidizes their semiconductor companies, providing funds or low to no-interest loans, causing chip prices to drop. It’s happened before. This subsidization was instrumental in businesses finding cheaper ways to do business—like offshoring.

- According to Semiconductors.org, it is currently 50% cheaper and 24% faster to build a semiconductor fab in Asia.

- Will local manufacturing address silicon shortfall? We are adept at design and have long used the fabless model with those now more highly specialized at manufacturing. Many companies are not supportive of the CHIPS Act and are more interested in such longer-term fixes as equivalent subsidies and tax breaks.

- U.S. regulations, the cost of labor, and the unlikelihood of lower corporate tax breaks will continue to impact manufacturing in the U.S negatively.

- Can the states that will benefit be able to supply and maintain the infrastructure needed?

- Outsourcing industrial policy to shareholder maximization has not worked out in the long term.

According to a recent Fortune opinion piece, Chipmaking CEOs say they need long-delayed CHIPS Act funding to save U.S. chip manufacturing. But it won’t work, points out that “…the CHIPS Act, which intends to use the money to encourage the onshoring of semiconductor manufacturing, is focusing on the wrong problem. Onshoring can’t be a long-term goal for the U.S., given its high manufacturing costs. A one-time $50 billion economic incentive, divvied up into grants no bigger than $3 billion at a time, is not significant enough to motivate onshoring even in the short term…”

While doing something is admirable, I’m not optimistic that the CHIPS Act provides a reasonable solution for the industry.