After dropping by 15% last year, the worldwide IC market is expected to show single-digit growth in 2020, even with the disastrous effects of Covid-19 on the global economy.

IC Insights will release its 200+ page Mid-Year Update to the 2020 McClean Report later this month. The Mid-Year Update revises IC Insights’ worldwide economic and IC industry forecasts through 2024 that were published in The McClean Report 2020, released in January.

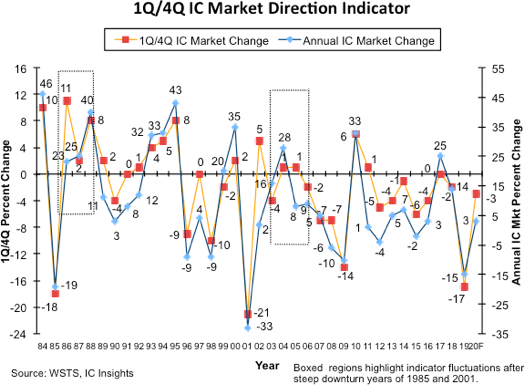

From 1984-2019, the average seasonal sequential decline in the 1Q IC market was 2%. In 1Q20, the IC market was down just 3% as compared to 4Q19, slightly below the 36-year average. Excluding the years after the severe IC industry downturns of 1985 and 2001, IC Insights believes that the 1Q/4Q sequential quarterly IC market change is a good indicator of the direction and intensity of the annual IC market change.

Note that Figure 1 is labeled as a ‘direction indicator’. This is because the actual 1Q/4Q change does not directly forecast the eventual annual IC market growth for a given year, but instead more accurately describes the expected direction and intensity of the annual IC market growth rate as compared to the previous year.

For example, 2017 showed 0% 1Q/4Q growth and 25% annual IC market growth, whereas 2011 displayed 1% 1Q/4Q growth but a full year IC market growth rate of only one percent, the difference being the 1Q/4Q change as compared to the previous year’s 1Q/4Q change.

The reason why this model is a good indicator of the direction of the IC industry’s annual growth rate lies in the seasonality of the IC market itself. Given the typical quarterly seasonal pattern that is characteristic of the IC industry, the first quarter essentially establishes a “base” upon which future quarterly IC market growth will build.

Overall, when the 1Q/4Q performance of a given year is better than the previous year’s 1Q/4Q result, the annual growth rate for that year can be expected to be better than the previous year. The opposite is usually true when the 1Q/4Q performance of the current year is worse than the year earlier. The 1Q20/4Q19 IC market change of -3% was much better than the -17% change in the 1Q19/4Q18 IC market. Therefore, IC Insights believes that the annual growth rate for the 2020 IC market, even after incorporating the negative impact of Covid-19, is likely to be much better (3%) than the 15% decline the IC market registered in 2019.