DRAM market braces for slower growth

In its September Update to The 2018 McClean Report, IC Insights has disclosed that over the past two years, DRAM manufacturers have been operating their memory fabs at nearly full capacity, which has resulted in steadily increasing DRAM prices and sizable profits for suppliers along the way.

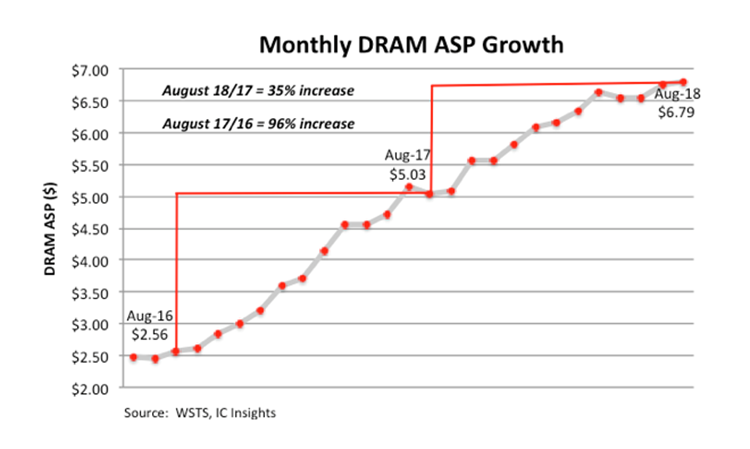

Figure 1 shows that the DRAM average selling price (ASP) reached $6.79 in August 2018, a 165% increase from two years earlier in August of 2016. Although the DRAM ASP growth rate has slowed this year compared to last, it has remained on a solid upward trajectory through the first eight months of 2018.

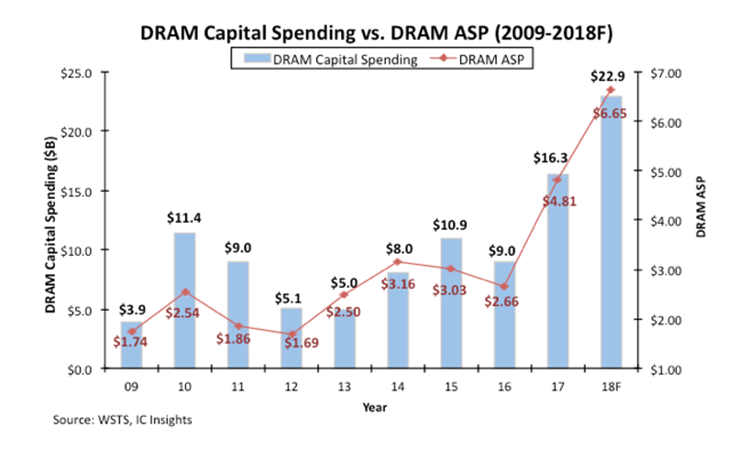

The DRAM market is known for being very cyclical and after experiencing strong gains for two years, historical precedence now strongly suggests that the DRAM ASP (and market) will soon begin trending downward. One indicator suggesting that the DRAM ASP is on the verge of decline is back-to-back years of huge increases in DRAM capital spending to expand or add new fab capacity (Figure 2).

The DRAM market is known for being very cyclical and after experiencing strong gains for two years, historical precedence now strongly suggests that the DRAM ASP (and market) will soon begin trending downward. One indicator suggesting that the DRAM ASP is on the verge of decline is back-to-back years of huge increases in DRAM capital spending to expand or add new fab capacity (Figure 2).

DRAM capital spending jumped 81% to $16.3bn in 2017 and is expected to climb another 40% to $22.9bn this year. Capex spending at these levels would normally lead to an overwhelming flood of new capacity and a subsequent rapid decline in prices.

However, what is slightly different this time around is that big productivity gains normally associated with significant spending upgrades are much less at the sub-20nm process node now being used by the top DRAM suppliers as compared to the gains seen in previous generations.

However, what is slightly different this time around is that big productivity gains normally associated with significant spending upgrades are much less at the sub-20nm process node now being used by the top DRAM suppliers as compared to the gains seen in previous generations.

At its Analyst Day event held earlier this year, Micron presented figures showing that manufacturing DRAM at the sub-20nm node required a 35% increase in the number of mask levels, a 110% increase in the number of non-lithography steps per critical mask level, and 80% more cleanroom space per wafer out since more equipment, each piece with a larger footprint than its previous generation, is required to fabricate ≤20nm devices.

Bit volume increases that previously averaged around 50% following the transition to a smaller technology node, are a fraction of that amount at the ≤20nm node. The net result is suppliers must invest much more money for a smaller increase in bit volume output. So, the recent uptick in capital spending, while extraordinary, may not result in a similar amount of excess capacity, as has been the case in the past.

As seen in Figure 2, the DRAM ASP is forecast to rise 38% in 2018 to $6.65, but IC Insights forecasts that DRAM market growth will cool as additional capacity is brought online and supply constraints begin to ease. (It is worth mentioning that Samsung and SK Hynix in 3Q18 reportedly deferred some of their expansion plans in light of expected softening in customer demand).

Of course, a wildcard in the DRAM market is the role and impact that the startup Chinese companies will have over the next few years. It is estimated that China accounts for approximately 40% of the DRAM market and approximately 35% of the flash memory market.

At least two Chinese IC suppliers, Innotron and JHICC, are set to participate in this year’s DRAM market. Although China’s capacity and manufacturing processes will not initially rival those from Samsung, SK Hynix, or Micron, it will be interesting to see how well the country’s startup companies perform and whether they will exist to serve China’s national interests only or if they will expand to serve global needs.