That the European electronic components DTAM (distributor total available market) is continuing to grow, has been reported by Adam Fletcher, Chairman of IDEA (International Distributors of Electronics Association). Consolidated returns from the association’s member companies average Billings (sales revenue invoiced, less credits) grew by seven percent in Q3 2018.

When compared to the same calendar quarter 2017, extending an ongoing period of double-digit growth going back to Q4 2015 and continuous growth spanning twenty calendar quarters. IDEA members are upbeat about the immediate future and believe that the European electronic components market will continue to grow into the final quarter of the year, albeit at a slightly slower pace.

They also believe that extending lead times will continue to impact availability of almost all electronic components (particularly large case size MLCC and chip resistors) until component manufacturers add manufacturing capacity.

Each month IDEA collates the statistical data reported by its member associations throughout Europe and consolidates it before publishing it as headline information. IDEA uses three primary metrics in its reporting process: ‘Billings’ (sales revenue invoiced, less credits), ‘Bookings’ (net new orders entered), and the ratio of the two known as the ‘Book to Bill’ (or B2B) ratio. All three metrics are important, but the ‘Billings’ number is possibly the most critical value.

Fletcher stated: “It’s the most accurate indicator of the performance of all organizations operating in the market. Organizations are able to use the ‘Billings’ figures to compare their actual operating performance with the market’s average sales revenue performance”.

The data presented in the following graphics is shown in K€ Euros and where necessary has been converted from local currency at a fixed exchange rate for the year.

Q2 ’18 bookings, billings and B2B

Graphic T1 is a visual representation of twelve quarters of billings and bookings together with the book-to-bill (B2B) ratio. A positive B2B number – i.e. greater than one – is an indicator of growth in electronic components markets but a number below one indicates a decline. A quick glance at the chart suggests all is well as the continuing trend is ‘up and to the right’. Further analysis shows a continuation of the historical pattern of a strong Q1 followed by a declining Q2, Q3 and Q4.

The year-to-date (Y2D) 2018 bars however reveal that strong momentum has been sustained throughout 2018, almost certainly due to the increases in manufacturing lead-time and some product shortages. A B2B of 1.04:1 is the ideal long-term trend as it represents sustained modest growth, while a spike up or down suggests some turbulence in the market. The slight Booking and Billings decline expected in Q4’18 will probably push the B2B ratio down to parity, i.e. 1:1, in the period.

Q2 ’18 bookings trend

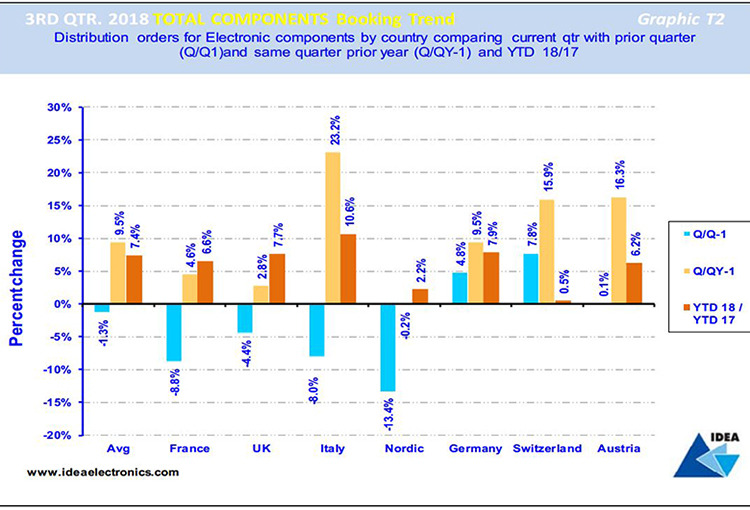

Graphic T2 compares the total electronic components bookings result achieved by each country in Europe in Q3’18 and contrasts and compares the results with the previous quarter’s results and those achieved in the same period last year.

The blue bar reveals that Average Bookings declined by (1.3%) across Europe in Q3’18 when compared to the previous quarter. Note that bookings in French, UK, Italian and Nordic components markets declined at a faster rate than the European average but the German, Swiss and Austrian markets all showed bookings growth.

The light brown bar compares Bookings growth by country in Q3’18 with those in the same quarter 2017 and indicates that Bookings growth in Italy, Switzerland and Austrian electronic components markets increased faster than the European average of 9.5% in the period. Germany sits centrally on the average, while the French, UK and German markets performed below the average.

The dark brown bar compares average bookings achieved Y2D with the same period in 2017, revealing an average bookings growth rate of 7.4% over the 12 month period. Note that the UK, Italy and German markets grew faster than the European average.

Q2’18 billings trends

Graphic T3 illustrates total electronic components billings achieved in European markets in Q3’18 and contrasts and compares the results with the previous quarter’s results and those achieved in the same period last year.

The blue bars compare Q3’18 billings with the preceding quarter’s figures revealing that the French, UK, German and Swiss electronic components markets grew faster than the European average of 0.7% in the period, with all the other countries returning a Billings decline greater than the average.

The light brown bars compare Q3’18 with the same quarter last year and reveals that all European electronic components markets, except the Nordic region experienced growth averaging out at 6.9%, with the French, UK and Italian markets growing faster than the average.

The dark brown bars compare billings in the current Y2D with the same period 2017, revealing that billings in the UK, Italian, Swiss and Austrian components market grew faster that the European average of 7.3%. Germany is hovering just below the average while France is lagging behind with a decline of one percent.