It has been announced that IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, a detailed quarterly IC market forecast for the remainder of this year, and a look at the top 25 1Q19 semiconductor suppliers.

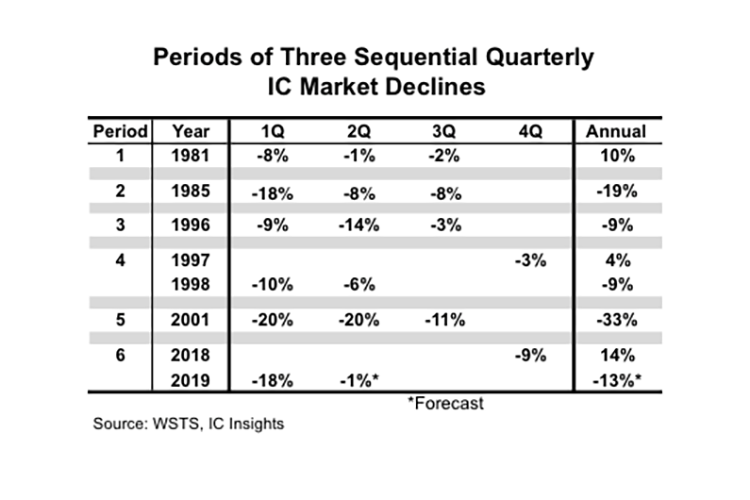

Over its 60 year history, the IC industry is well known for its cyclical behavior. Looking back to the mid-1970s, IC Insights cannot identify a period where the IC market declined for more than three quarters in a row. Assuming the 2Q19 IC market registers a slight decline of one percent as compared to 1Q19, the 4Q18-2Q19 time period would mark the sixth three-quarter IC market drop on record.

As shown, there hasn’t been a three-quarter decline in the IC market since 2001. Moreover, the three-quarter decline in 2001 was the steepest on record, with three double-digit declines, which led to the most severe annual IC market drop in history with a 33% plunge.

As shown, there hasn’t been a three-quarter decline in the IC market since 2001. Moreover, the three-quarter decline in 2001 was the steepest on record, with three double-digit declines, which led to the most severe annual IC market drop in history with a 33% plunge.

Given that the IC industry has never registered a four-quarter sequential IC market decline, expectations are high for a rebound in IC market growth beginning in 3Q19. While the US and China trade war is an unpredictable ‘wildcard’ for near-term IC market growth scenarios, 3Q19 is currently expected to display the largest percentage growth in the quarter after a three-quarter downturn in IC industry history.

However, even with a strong rebound in IC sales in 2H19 as compared to 1H19, the total IC market is forecast to drop by 13% this year, with more downside than upside risk to this forecast.