The telecommunications industry’s first Competitive Landscape Assessment (CLA) of the 5G Radio Access Network (RAN) infrastructure solutions space has been researched and published by GlobalData, a leading data and analytics company.

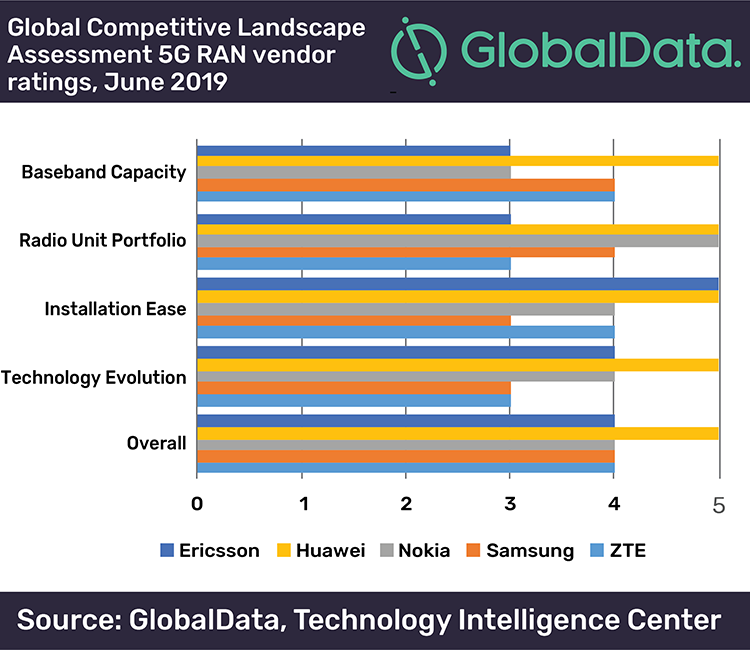

The company’s report, ‘5G RAN: Competitive Landscape Assessment’, evaluates the 5G mobile base station portfolios of five key vendors: Ericsson, Huawei, Nokia, Samsung and ZTE. It examines the details of each portfolio in the context of key criteria important to mobile operators including: baseband unit capacity, radio unit portfolio, installation ease and technology evolution.

Among the reports key findings:

- Huawei’s 5G RAN portfolio holds the strongest position overall, with leading claims in all four criteria categories, including superior baseband unit capacity and radio unit portfolio breadth.

- Ericsson’s greatest strengths lie in solutions for easing radio installation, such as its Street Macro and Vault Radio offerings, an area in which the vendor holds a leading position.

- Nokia is strongest in its radio unit portfolio, whose breadth of options and compact form factors helped the vendor earn a rating of leader in the radio portfolio category of GlobalData’s analysis.

The report serves as both a guide for mobile operators that need to select RAN suppliers as well as a tool for vendors to use to gage their competitive position relative to rivals. It also makes recommendations to operators and vendors alike to aid their respective efforts.

“The 5G RAN market is extremely competitive in these early stages,” said Ed Gubbins, Principal Analyst at GlobalData. “Operators’ decisions today will direct the next decade of global telecom investment and ultimately usher in fundamental changes to the way we live and work in the 5G era.”

The report also examines trends and drivers in the 5G RAN space. For example, although Internet-of-Things (IOT) use cases will be a major driver of 5G infrastructure going forward, in the very near term, 5G decisions are being guided largely by enhanced mobile broadband services. As the 5G RAN market evolves, GlobalData’s assessment will focus more on IoT capabilities.

The vendor landscape is changing rapidly, as Gubbins explains: “The first wave of 5G RAN equipment, called ‘non-standalone 5G’ relies on existing 4G LTE infrastructure for some functions. So in the race to win 5G deals with operators, each vendor has a strong advantage with operators that already use their 4G gear.

“Standalone 5G, which requires a 5G core, will give vendors a better chance to penetrate new operator accounts and grow their global market share. We expect the standalone 5G RAN market to start ramping up in 2020.”