In its May Update to the 500-page, 2019 edition of ‘The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry’, IC Insights will report on and examine the 1Q19 worldwide IC market results.

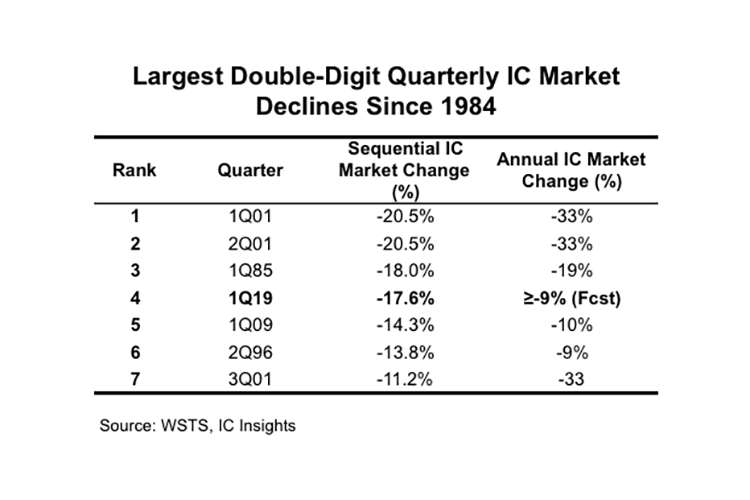

From 1Q84 through 1Q19 there have been 141 quarters, and only seven of them registered an IC market decline of more than 10%. The table below ranks the largest double-digit sequential quarterly IC market declines that have occurred since 1984. As shown, the 1Q19/4Q18 IC market decline of 17.6% was the fourth largest since 1984 and the third largest first quarter decline over that same timeperiod.

As shown, each year in which a double-digit quarterly IC market decline occurred, the full-year IC market dropped by at least nine percent. It is interesting to note that three of the seven largest quarterly IC market downturns since 1984 took place during the first three quarters of 2001, which put the 3Q01 IC market 44% below that of 4Q00. As a result, 2001’s disastrous full-year IC market decline of 33% still stands as the worst annual performance in the history of the IC industry.

The first quarter is usually the weakest quarter of the year for the IC market, averaging a sequential decline of 2.1% over the past 36 years, but the severity of the 1Q19/4Q18 IC market drop has started this year off at a very low level.

As a result, given the typical seasonality of the IC market, an abnormally strong second half of the year will be required in order to avoid a full-year 2019 double-digit IC market decline.