Half of Spain’s installed power capacity to be non-hydro renewables

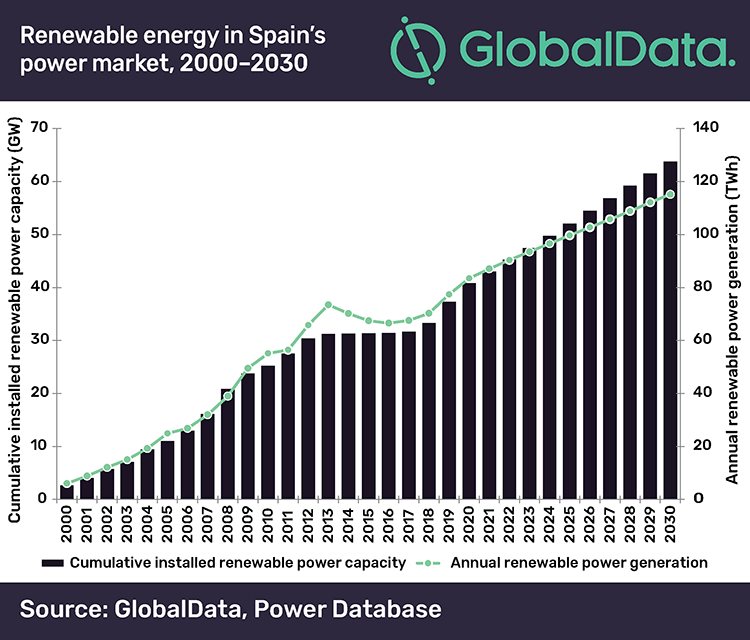

Spain’s total installed power capacity increased from 55.5 gigawatt (GW) in 2000 to 104.4GW in 2017 at a compound annual growth rate (CAGR) of 3.8% between 2000 and 2017, according to GlobalData, a leading data and analytics company. Growth is expected to continue, though at a lower CAGR of 1.8%, between 2018 and 2030, reaching 131.1 GW in 2030.

The company’s latest report: ‘Spain Power Market Outlook to 2030, Update 2018’ states that the share of non-hydro renewables in Spain’s capacity mix was just under 5% in 2000 and this increased six-fold to 30.3% in 2017.

Spain still needs to expand its renewable energy sector to reduce its dependence on thermal power sources. It derives most of its electricity from thermal power sources but does not have large reserves of fossil fuels, forcing it to depend on gas imports from Algeria, Nigeria, Qatar, and Egypt and oil imports from the Middle East. Domestic coal reserves are of poor quality, necessitating imports from South Africa, Colombia, the US, and Russia.

Chiradeep Chatterjee, Power Analyst at GlobalData, stated: “Spain’s new socialist government that came to power in June 2018 adopted a more aggressive posture regarding renewable energy and supported a move in the EU, of which it is a member, to increase the target for renewable energy sources from the present 27% to 35% by 2030. The EU finally increased its target to 32% by 2030, which is binding for all its members.

“As a result of this policy shift, our analysis shows that solar PV capacity in Spain will grow at a CAGR of 13.1%, while onshore wind capacity will grow at a CAGR of 3.3% between 2018 and 2030. Non-hydro renewable energy sources are expected to contribute to 48.6% of the total capacity mix in 2030.”

Spain’s geographical location works particularly in favour of solar power, allowing for the higher growth rate. The southern part of the country is sunny resulting in a greater potential for solar power. Furthermore, its location at the southern tip of Europe allows it to act as a hub for the import of cheap solar power from North Africa and beyond.

Chatterjee added: “Much of the development of renewable energy in the country was due to its attractive feed-in tariff (FiT) program followed by the government until 2012. The phasing out of FiTs in 2012 hit the development of this sector. As a result, the share of non-hydro renewables in Spain’s capacity mix increased from 29% in 2013 to only 29.9% in 2016.”

Spain is now developing its renewable energy sector through auctions. In May 2017, the government auctioned three gigawatts of renewable capacity, nearly all of which was cornered by wind power developers. The next round of auctions for another five gigawatts of renewable energy was held on July 26, 2017.