It has been announced that IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers. The top-15 1Q19 semiconductor suppliers are covered in this research bulletin.

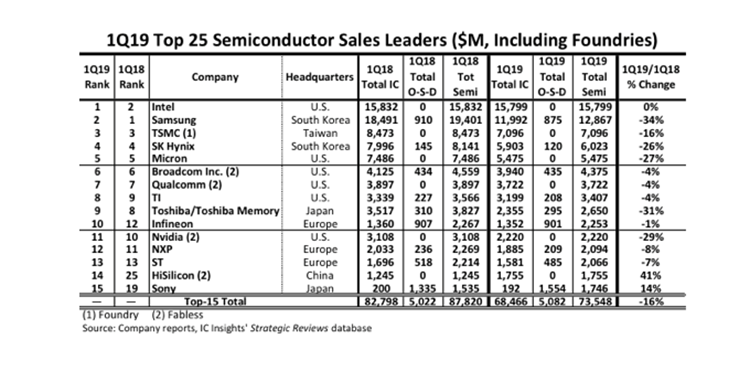

The top-15 worldwide semiconductor (IC and O S D – optoelectronic, sensor, and discrete) sales ranking for 1Q19 is shown in the table below. It includes six suppliers headquartered in the US, three in Europe, two each in South Korea and Japan, and one each in Taiwan and China.

Intel replaced Samsung as the number one quarterly semiconductor supplier in 4Q18 after losing the lead spot to Samsung in 2Q17. While Samsung held the full-year number one ranking in 2017 and 2018, Intel is forecast to easily recapture the number one ranking for the full-year of 2019, a position it previously held from 1993 through 2016. With the collapse of the DRAM and NAND flash markets over the past year, a complete switch has occurred, with Samsung having 23% more total semiconductor sales than Intel in 1Q18 but Intel having 23% more semiconductor sales than Samsung just one year later in 1Q19.

In total, the top-15 semiconductor companies’ sales dropped by 16% in 1Q19 compared to 1Q18, three points worse than the total worldwide semiconductor industry 1Q19/1Q18 decline of 13%. Illustrating the extreme volatile nature of the memory market, the Big three memory suppliers – Samsung, SK Hynix, and Micron, each registered year-over-year revenue declines of at least 26% in 1Q19 after each company posted greater than 40% year-over-year growth one year earlier in 1Q18.

Thirteen of the top-15 companies had sales of at least $2.0bn in 1Q19, one company less than in 1Q18. As shown, it took over $1.7bn in quarterly sales just to make it into the 1Q19 top-15 semiconductor supplier list.

There were two new entrants into the top-15 ranking in 1Q19, HiSilicon and Sony. As shown, China-based fabless IC supplier HiSilicon jumped up 11 spots in the ranking to 14th place on the back of a 41% surge in year-over-year sales in 1Q19. Sony also posted a solid year-over-year sales increase of 14% in 1Q19 driven by its primary product line of image sensors.

The top-15 ranking includes one pure-play foundry (TSMC) and four fabless companies. If TSMC were excluded from the top-15 ranking, Taiwan-based fabless supplier MediaTek ($1,711m) would have been ranked in the 15th position.

IC Insights includes foundries in the top-15 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a marketshare ranking, and realizes that in some cases the semiconductor sales are double counted.

With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant ‘holes’ in the list of top semiconductor suppliers. As shown in the listing, the foundries and fabless companies are identified.

In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

Overall, the top-15 list shown in the table is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies, or foundries.

Many of the major semiconductor companies’ have provided their sales guidance for 2Q19 as well as for the full year, which will be presented and discussed in the May Update. Overall, the 2Q19 semiconductor revenue expectations vary widely by company and currently span a range of 20 percentage points.

As part of the May Update, IC Insights will also discuss its expectations for worldwide quarterly IC market growth for the remainder of this year.