Molex has announced the results of a global survey of Industry 4.0 manufacturing stakeholders driving advancements in robotics, complex machines and device or control systems. The findings reflect steady progress in the development of Industry 4.0 initiatives across the industrial automation ecosystem, including smart automation, connectivity and analytics that add efficiency and intelligence throughout the manufacturing lifecycle.

“It’s gratifying to see widespread Industry 4.0 progress, as the Fourth Industrial Revolution is pivotal to fulfilling the promises of digital manufacturing,” said John Newkirk, VP and general manager, Industrial Solutions, Molex. “Ensuring success requires a pragmatic approach, organisational alignment and secure connectivity solutions that drive operational efficiency while boosting manufacturing flexibility and reducing costs.”

Molex commissioned third-party research firm, Dimensional Research, to conduct The State of Industry 4.0 Survey in June 2021, polling 216 qualified participants in a variety of roles, such as R&D, engineering, production manufacturing, strategy, innovation, and supply chain management. The primary research goal was to capture data on practical real-life Industry 4.0 experiences and opinions. Overall, the survey respondents validated continued growth, potential customer benefits and expected business outcomes emerging from the Industrial Internet of Things (IIoT) and smart manufacturing.

Key findings include:

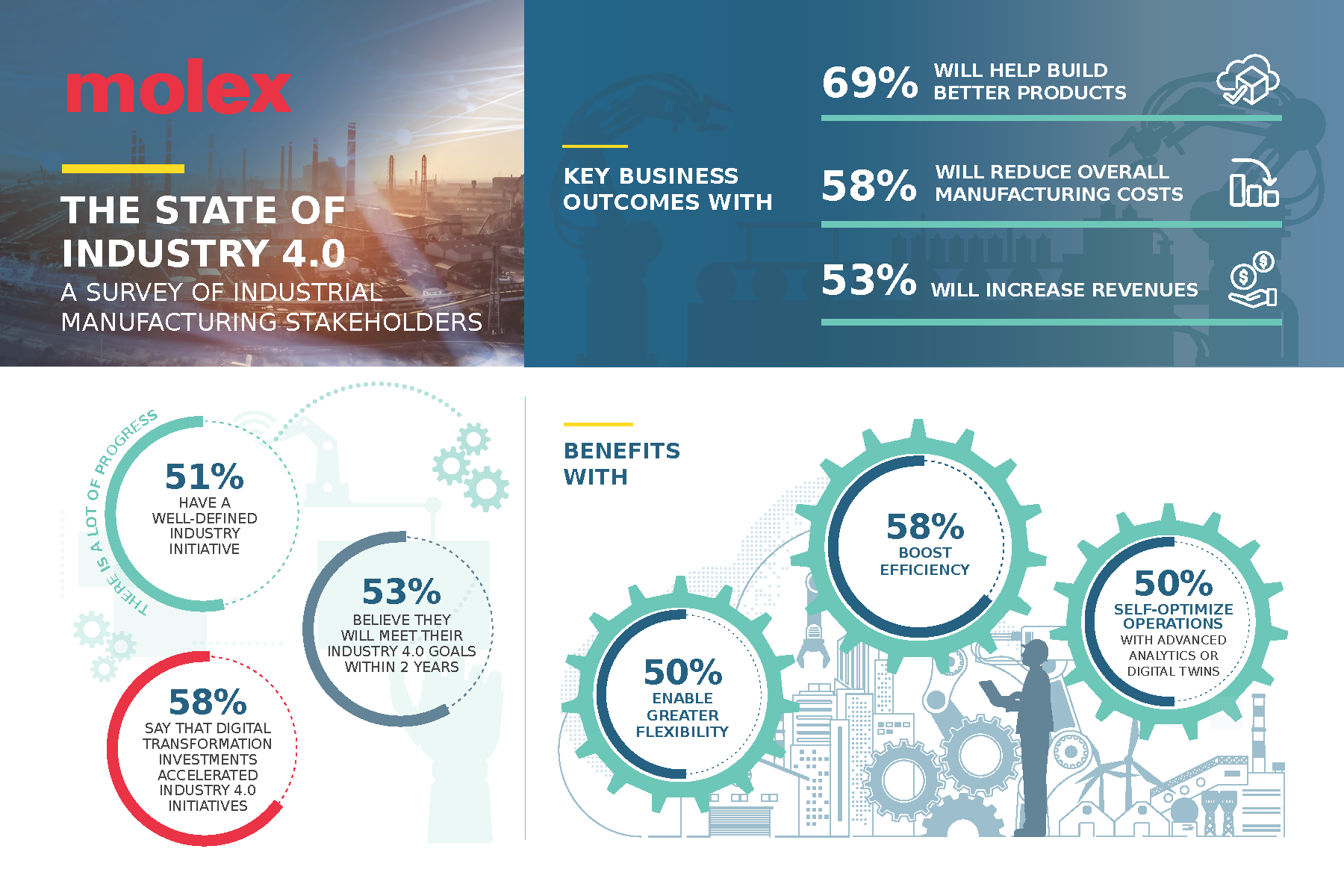

- 51% of those polled report having a well-defined Industry 4.0 corporate priority with executive sponsorship; 49% have already achieved success while 21% are still in the investment stage.

- More than half of the respondents expect to meet their Industry 4.0 goals within two years while a third believe it will take three-to-five years to reach that milestone.

- 58% say that digital transformation investments have accelerated Industry 4.0 efforts.

- 44% of those polled find organisational and cultural adoption barriers hardest to overcome.

Driving impactful outcomes and benefits

According to the survey, the most impactful business outcomes encompass the ability to build better products (69%), reduce overall manufacturing costs (58%), increase revenues (53%), offer products at lower prices (35%) and decrease time-to-market of new solutions (35%). For machine builders, robot manufacturers and systems integrators, the opportunity to expand factory-floor automation and intelligence is expected to drive significant customer gains.

Among the most anticipated customer benefits are increased efficiency of robots, machines, and other manufacturing assets (58%); greater flexibility on manufacturing lines (50%); the use of advanced analytics or Digital Twins to self-optimise operations (50%); virtual design and simulation of new production facilities before making capital expenditures (42%); elevated labor productivity (41%); and unlocked access to real-time data across facilities (26%). Overall, a significant majority of survey respondents (87%) are excited about the transformative power of Industry 4.0 over the next decade.

Among the capabilities considered most beneficial to their organisations’ Industry 4.0 efforts, respondents cited machines embedded with ample intelligence to control their own processes while interacting externally (53%), remote access to all production lines and machines (47%) and versatile connectivity solutions that include Internet (40%).

Overcoming persistent challenges

Despite overwhelming optimism for the Fourth Industrial Revolution, persistent cultural, business model and technology challenges thwart implementation. Nearly half of those polled identified problems with leadership that doesn’t advocate for change, making it more difficult to reap full value from investments. Other cultural issues impeding success include problems finding staff with data and analytics skills (35%); organisational structures that limit information and systems sharing (32%); underfunded, insufficiently staffed pilot projects (30%); and lack of expertise in connected technologies (28%).

Most of the respondents also face major business model challenges, spurred by a range of complex and costly requirements, such as difficult funding decisions (45%), upfront investments that complicate ROI (42%) and lack of clarity on which use cases pose the greatest payoffs (40%). A litany of technology hurdles exist, including separate IT and OT network infrastructures (43%), restrictive communications protocols (39%), limited remote access (36%), cloud infrastructure and data solutions not aligned with manufacturing needs (34%) and inadequate security capabilities (32%). Ultimately, 85% of the survey participants were in strong agreement that a change in how leadership thinks is critical to empowering Industry 4.0 initiatives to thrive.